Join us as we celebrate six years of leading CX innovation in the APAC region. Discover our journey!

The Singapore SMS Sender ID Registry (SSIR) is a new initiative by the Infocomm Media Development Authority (IMDA) aimed at tackling unsolicited and fraudulent SMS messages.

The SSIR, which went into effect on January 31st, requires organisations to register in order to send SMS messages. If an organisation is not registered, the SMS messages it sends will be labeled as “likely scam.” This new anti-fraud initiative has significant implications for businesses that rely on SMS as a communication tool.

In this article, we will:

- Examine what happened recently with the implementation of the Sender ID Registry,

- Provide guidance on how businesses can avoid having their SMSes labeled as “likely scam.”

- Recommend how businesses should look beyond SMS communications.

What is the “Likely Scam” folder?

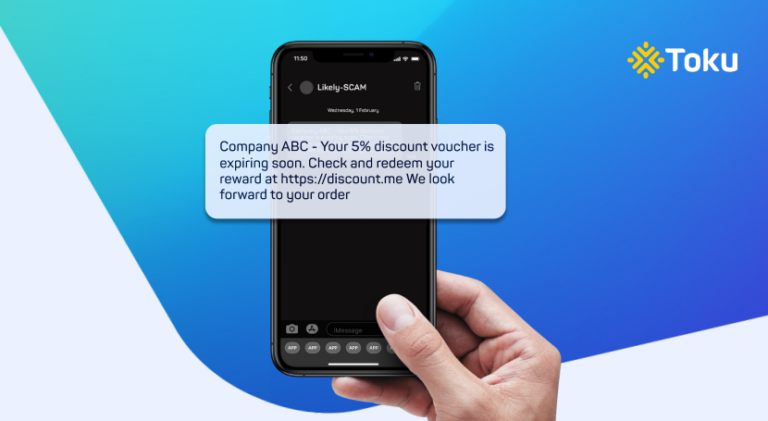

If you receive text messages from businesses that aren’t registered with SSIR, they’ll be marked as “Likely-SCAM” on your phone.

These messages might come from different sources, but they’ll all be grouped together in the same text message thread.

This can be confusing, especially if a customer gets messages from completely legitimate businesses – it’s just that they haven’t registered with SSIR, or are still completing their registration.

For example, you might receive One Time Passwords (OTPs), parcel tracking updates, and reward links all labeled as “Likely-SCAM.”

Sometimes you will actually see the SMS in question.

In this case, at least you know an SMS was sent.

Likely-SCAM SMS may not be even seen

However, if a user receives a text from a business not registered with SSIR, it’s possible they may not even see a notification for it – meaning they will be completely unaware they received any SMS from the business.

This is because some phones’ OS (Operating Systems) have a filtering system that’ll put all those suspicious texts into a “spam” or “malicious” folder, without even notifying you.

In a way, not being aware you received an SMS is just as bad – if not worse – than receiving an SMS that makes you aware it might be a ‘Likely-SCAM.’

That’s because in many cases, the customer might be expecting an SMS from you, and if they are not aware you sent anything, what kind of impression will they get?

- Your business is unresponsive

- Your systems and processes are not working properly

- You’ve abandoned them

This can seriously damage any company’s reputation, and as we’ll see in the following section, the impact on your bottom line can be very real.

How being labelled Likely-SCAM impacts business operations

If you read our primer on what to expect with the SSIR, you’ll know that practically every business sends SMS for various functions.

And as we saw with the initial rollout of SSIR, some very important operations were indeed impacted simply because many businesses did not manage to register in time.

Here are just a few recurring scenarios we came across in the news:

1. Login OTP SMS being sent to the “spam” folder

For any business (like an ecommerce, bank, or insurer, etc.) that relies on login OTPs to authenticate customers via SMS, getting sent to the “spam” folder without the user being aware can cause immense confusion and even lost business revenue.

Because the customer cannot login, they may give up and move on to other online retailers for their purchase.

2. Parcel delivery SMS were sent but not seen

Practically every logistics and delivery service sends SMS to keep customers updated on their package deliveries. But because some of these messages were directed to the spam folder, many customers had no idea when their parcels would be delivered, or if they had shipped in the first place.

3. Booking confirmations confused users they had been scammed

Some customers received travel ticket confirmations via SMS that were flagged as ‘likely scam.’ Being confused, they proceeded to double-check their bookings via the respective companies’ app or website.

When they realised the bookings were indeed confirmed on the companies’ platform, they felt reassured.

The way forward for businesses

As a business operating in Singapore, if you depend on SMSes to communicate anything with customers, you can save yourself a lot of headache by registering with SSIR.

You can do so via https://smsregistry.sg/web/login.

But that’s not all you should do.

1. Partner with an experienced provider

In our experience, a common reason many businesses did not register for SSIR in time was because they still had a lot of doubts about registering and prepping for the registration.

If this sounds like you, you should definitely work with a service provider who has the expertise to guide you through the registration process and help ensure that your business is fully prepared.

By partnering with an experienced provider, you can avoid common headaches and be confident that your business will thrive in the rapidly evolving world of SMS communication.

At Toku, we are based in APAC and have first-hand experience delivering reliable messaging in many regional markets that are complex and tough to navigate. We’re also a licensed operator in Singapore supporting the SMS portfolios for retailers, enterprises, and telcos.

2. Look beyond SMS, to in-app communications

Even as businesses grapple with the new SMS regulation to thwart scammers, we think it’s good to look beyond SMS.

That’s because scammers are always finding new ways to scam people, and now they’re shifting to instant messaging apps like WhatsApp and Telegram. These apps make it easier for them to pretend to be someone else, making it harder for authorities to stop them.

The onus is on businesses to take control and find alternative ways to communicate with their customers where they have more ownership of the channel.

A great example we mentioned earlier is the in-app communication channel.

Because some companies had their own apps, which contained accurate details of all transactions and communications, this helped reassure confused customers their bookings were indeed safe and confirmed.

Key takeaway: Because you own the in-app channel, you can ensure trust and safety for your customers and give them peace of mind.

Toku helps businesses centralise transactions and communications in their app, allowing customers to connect to their customer support, in a trustworthy environment.

Protect your business from the Likely-SCAM SMS label

In conclusion, the SMS label “Likely Scam” under SSIR can have significant impacts on a business, including damage to reputation, loss of customer trust, and loss of revenue.

It is in companies’ interest to be proactive and comply with all local telco regulations and laws. This includes registering for SSIR and addressing any concerns promptly before it’s too late.

As the regulator has indicated,

“From 31 January 2023 onwards, all non-registered Sender IDs will be marked as “Likely-SCAM” as a default for a transition period of 6 months. Thereafter, messages with such non-registered Sender IDs will be blocked and not delivered to end-users.”

So, do yourself a favour and register today if you’ve not done so already.

By taking this simple step, you can protect your business from potential scams and maintain a positive customer experience.

Ultimately, scammers’ tactics will evolve with changes in technology and the regulatory environment, so businesses must adapt quickly if they wish to ensure business continuity with minimal disruption.

Benson Chan

Benson Chan

Thomas Laboulle

Thomas Laboulle

V K Sanjeed

V K Sanjeed

Ana Castrillon

Ana Castrillon