- The Singapore-incorporated AI-powered customer experience (CX) platform secures full subscription on SGX Catalist, raising S$16.25 million at S$0.25 per Invitation Share.

- The Public Offer attracted strong interest and was 31.9 times subscribed, from 1,115 valid applications for 63,888,300 Public Offer Shares, with 2,000,000 Public Offer Shares available for subscription.

- Top-tier institutional investors including Lion Global Investors Limited (as investment manager for and on behalf of its clients), Amova Asset Management Asia Limited, Asdew Acquisitions Pte Ltd and Ginko-AGT Global Growth Fund, participated in the offering, validating Toku’s AI-powered enterprise CX strategy and growth trajectory.

Capitalised terms used herein shall, unless otherwise defined, bear the same meanings ascribed to them in the offer document of Toku Ltd. registered by the Singapore Exchange Securities Trading Limited, acting as agent on behalf of the Monetary Authority of Singapore on 14 January 2026 (the “Offer Document”).

Singapore, 21 January 2026 – Toku Ltd. (“Toku” or the “Company”), a Singapore-incorporated AI-powered customer experience (CX) platform, today announced the successful close of its initial public offering (the “IPO”). The Company will be listed on the Catalist Board of the Singapore Exchange Securities Trading Limited (the “SGX-ST”) following the completion of the offering, marking the first SGX IPO of 2026.

PrimePartners Corporate Finance Pte. Ltd. is the Sponsor, Issue Manager, Underwriter and Co-Placement Agent for the IPO, while CGS International Securities Singapore Pte. Ltd. is the Co-Placement Agent.

The IPO attracted participation from institutional investors including Lion Global Investors Limited (as investment manager for and on behalf of its clients), Amova Asset Management Asia Limited, Asdew Acquisitions Pte Ltd and Ginko-AGT Global Growth Fund, strengthening the Company’s shareholder base and positioning Toku for its next phase of growth. The successful listing also builds on Toku’s reported 47% revenue growth and Net Revenue Retention exceeding 150% for its Subscription and Licensing revenue stream over the past three years, reflecting strong market demand for its AI-driven CX solutions.

The Invitation was in respect of 65,000,000 Invitation Shares, comprising 2,000,000 Public Offer Shares at S$0.25 for each Public Offer Share by way of a public offer in Singapore, and 63,000,000 Placement Shares at S$0.25 for each Placement Share by way of placement. The Public Offer drew strong interest, with 1,115 valid applications for 63,888,300 Public Offer Shares received, representing a subscription rate of 31.9 times. The Placement Shares were fully subscribed at the close of the placement at 12.00 noon on 20 January 2026.

Trading of the Shares will commence on a “ready” basis at 9:00 am SGT on 22 January 2026, under the ticker symbol TKU.

The Invitation has successfully raised total gross proceeds of S$16.25 million. Based on the Invitation Price and the post-Invitation share capital of the Company of 570,241,255 Shares, the Company’s post-IPO market capitalisation is S$142.56 million.

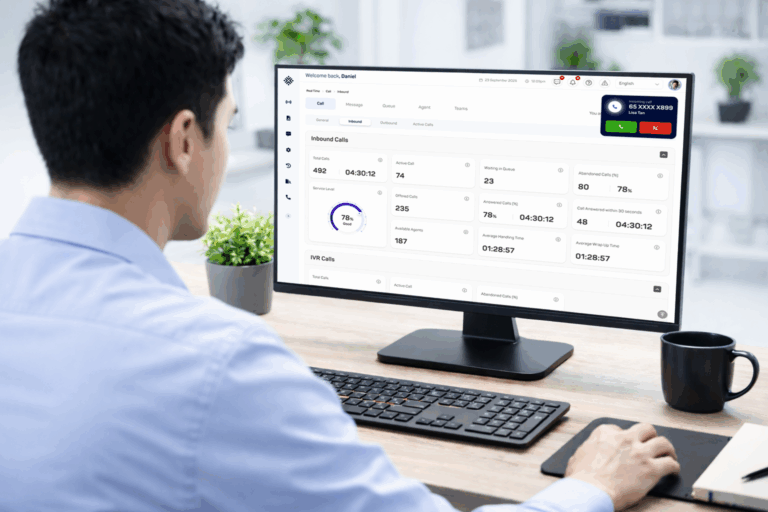

Toku helps enterprises deliver seamless, intelligent, and scalable customer interactions. Built as a cloud-native solution, Toku enables organisations across multiple markets to improve engagement, operational efficiency, and customer satisfaction, combining advanced AI capabilities with deep expertise in serving regulated industries and diverse markets.

“This IPO reflects the confidence investors have in our vision to reimagine customer experience for enterprises,” said Thomas Laboulle, Founder and CEO of Toku. “With the capital raised, we will scale our platform globally, deepen our AI capabilities, and grow through strategic partnerships and acquisitions. We have always thrived where complexity is greatest, and this listing allows us to bring that strength to more businesses worldwide.”

About Toku

Headquartered in Singapore, Toku Ltd. (“Toku”) is a cloud-native, AI-powered customer experience platform purpose-built for enterprises operating in complex, multi-market environments. With deep roots in the APAC region and an expanding global footprint, Toku’s modular 360° CX Platform orchestrates customer interactions across voice, chat, email and digital channels while managing regulatory, linguistic and infrastructure complexity at scale.

Built on end-to-end ownership of its technology stack, from carrier-grade connectivity to AI applications, Toku delivers enterprise-grade security, reliability and deployment flexibility across commercial cloud, private data centres and hybrid environments. Its AI capabilities include transcription, summarisation, sentiment analysis, conversation analytics and governed virtual agents, designed to integrate seamlessly with enterprise systems and customer data.

Trusted by leading enterprises and public-sector organisations, Toku helps organisations streamline operations, scale customer engagement and deliver consistent experiences across fragmented markets.

For more information about Toku, visit toku.co

INVESTOR RELATIONS CONTACT

MEDIA CONTACT

The Hoffman Agency

Nora Huin

Nora Huin