If you have a business with operations in Singapore and are looking to register in the Singapore SMS Sender ID Registry (SSIR) before January 31, 2023, here is what you need to do.

Businesses have long favoured email and SMS for customer interactions. However, the quest for achieving omnichannel engagement has seen many rush to adopt a slew of Over-the-Top (OTT) messaging platforms such as WhatsApp, Instagram, and Messenger.

This eagerness to go ‘all-in’ on omnichannel can sometimes lead to businesses neglecting the importance of the humble, traditional SMS – which is still the only communication channel everyone can access without having to download an app.

In this post, we will explore the differences between SMS and OTT messaging channels, discuss their advantages and disadvantages, and touch on some relevant data points we unearthed in our Singapore Consumer Engagement Report 2023.

Check out for the full report for all the details:

>> Read Toku Singapore Consumer Engagement Report 2023

How does OTT differ from SMS?

OTT messaging leverages the internet to send text-based messages via platforms such as Facebook Messenger, WhatsApp, Telegram, LINE, and WeChat. It falls under the larger umbrella of OTT services, which operate on top of existing internet networks and include various media and communication technologies like streaming devices and internet calling.

These messaging applications have gained global traction due to their easy accessibility for anyone with an internet-connected smartphone or tablet. OTT platforms have transcended personal use and are now pivotal in the way consumers engage with businesses.

Comparing OTT messaging with traditional SMS, the process of sending a message feels similar to the user, but there are some differences, such as:

- SMS communicates through cellular networks, whereas OTT messages transit via the internet.

- SMS can incur costs based on one’s mobile plan, but OTT messages avoid these fees, requiring only an internet connection

- SMS is built into mobile devices, as opposed to OTT services which must be downloaded as separate applications.

- OTT platforms boast a wealth of features like read receipts, higher character counts beyond SMS’s 160-character limit, the ability to send larger files and rich media, and the option to create group chats.

The humble SMS remains a trusted communication platform with customers

Contrary to the perception of traditional SMS as antiquated, it has consistently proven its worth as a dependable and trusted medium.

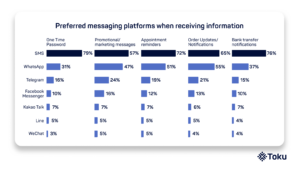

Data from our Singapore Consumer Engagement Report 2023 underscores its dominance; for instance, when it comes to one-time passwords (OTPs), SMS is the preferred platform for a whopping 79% of consumers, reflecting its pivotal role in secure communication.

Similarly, SMS is the top choice for appointment reminders (72%) and bank transfer notifications (76%), emphasising the trust and reliability consumers place in SMS for critical information.

But what gives SMS such unwavering consumer confidence?

The impressive reach of SMS—accessible to 100% of mobile phone users, regardless of internet connectivity—stands as a testament to its inclusivity.

This is a significant consideration in the APAC region where, despite the ubiquity of smartphones, many areas still grapple with below-average mobile internet speeds and high connectivity costs.

In such scenarios, the ability of SMS to bridge communication gaps is invaluable.

But that’s not all.

What do consumers associate with SMS?

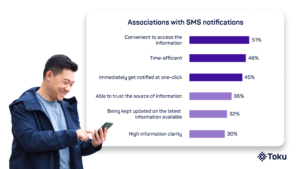

In order to get a better idea of what’s going on in a consumer’s mind that causes them to prefer SMS for certain types of communications, we asked them what they associate with their SMS experience when seeking out information/clarifications.

As seen above, consumers have these factors top of mind when they think about using SMS for seeking information and/or clarifications:

- Convenience,

- Time-efficiency, and

- Getting immediately notified with one click

Things get more interesting when we look at the numbers for different age groups.

For instance, more 55-65 year olds (62%) prefer SMS for its convenience than the pool of respondents in general (51%).

Similarly, more 55-65 year olds (58%) think SMS is time-efficient, in contrast to only 39% of 35-44 year olds.

Takeaways:

- The discernible preference for SMS among older demographics, notably those between 55 and 65 years old could be attributed to the straightforward and non-intrusive nature of SMS. Unlike OTT messaging apps which require navigating through a new and unfamiliar interface (which is often constantly updated, and hence, in a state of flux), SMS is relatively unchanged and therefore much for familiar for a user to navigate.

- Furthermore, the contrast in attitudes towards SMS between the 55-65 age group and the 35-44 age group highlights the need for a multi-channel strategy. Younger consumers may find greater appeal in-app communications for time-efficient communications. Therefore, businesses should not adopt a one-size-fits-all approach but rather align their communication methods with the preferences of specific customer segments.

Why SMS is often better than OTT messaging for businesses

The advantages of OTT platforms cannot be dismissed; they provide engaging user experiences with capabilities like group chats, media sharing, and voice messages. These platforms ride on the back of existing internet services, making them easily accessible to anyone with a smartphone and data connection.

However, the very foundation that makes OTT platforms convenient also introduces a few risks.

Lack of regulatory oversight

OTT services are predominantly under the jurisdiction of private entities, leading to less regulation and potential privacy concerns. Unlike SMS, which is governed by strict regulations to protect consumer privacy, OTT platforms operate in a grey area.

This lack of stringent oversight has led to controversies, especially when it comes to the handling of user data.

Lack of control over any policy changes

More importantly, enterprises must remember that any policy changes within these private entities can occur without warning, directly impacting their business communication strategies and customer experience (CX).

In other words, businesses must think twice before placing their CX at the mercy of a single entity’s impulses.

Pros of SMS for business

SMS, in contrast, offers a level of stability that OTT services can’t match.

It doesn’t rely on the internet or a data connection, which means it provides consistent service even in areas with poor connectivity—an essential feature in regions where internet services are unreliable or costly.

Furthermore, SMS is not subject to the whims of private enterprises’ corporate policy shifts, ensuring a steady and predictable platform for critical communications.

OTT applications also require a smartphone for access, whereas SMS is a universal service available on all types of mobile phones. This means that SMS delivers a more universal and inclusive reach, connecting with customers regardless of age group, device type or whether they have internet access.

This universal accessibility is especially critical for time-sensitive and confidential information, such as OTPs, bank notifications, and appointment reminders, where the immediacy and reliability of SMS are paramount.

Why partnerships with telcos matter for SMS success

Even though we are still upbeat about the potential of success with SMS for businesses, we cannot ignore the fact that stringent regulatory requirements – which often differ from country to country – are difficult for enterprises to navigate.

This is precisely where the role of a strategic telco partnership becomes vital.

Such alliances are essential for businesses that want to harness the high trust levels associated with SMS while navigating the complexities of compliance and maximising the channel’s potential.

Working with a knowledgeable partner such as Toku can offer companies significant advantages, particularly in complex regulatory landscapes like that of the Asia-Pacific region.

Here’s how businesses stand to gain:

- Navigating Compliance with Confidence: Companies benefit from Toku’s expertise in regional regulations, ensuring their communication strategies adhere to local laws, thereby minimising the risk of costly legal issues or fines.

- Customised Communication Solutions: Toku’s grasp of diverse regulatory frameworks allows for the creation of tailored communication solutions that respect local nuances, delivering more effective customer engagement.

- Scalability: As companies grow, Toku’s expertise can be instrumental in scaling communication efforts across various APAC markets without the added burden of deciphering each region’s regulatory code.

- Cost Efficiency: Toku’s in-house knowledge helps avoid the financial burden of regulatory non-compliance and the associated costs of navigating these complexities independently.

By offering expertise in areas such as message delivery optimisation, compliance adherence, and even international messaging regulations, a telco partner transforms SMS from a basic communication tool into a strategic business asset that gives them a competitive edge in achieving operational efficiency and customer satisfaction.

Keep the trust: SMS’s enduring role with customers

When comparing SMS and OTT messaging, it’s clear that while OTT platforms offer a modern twist on communication with their rich features, they still fall short in terms of universal accessibility and regulatory oversight.

Our data demonstrates that SMS, with its simplicity and wide reach, continues to hold the throne in the business communication realm, providing a reliable and secure channel that is accessible to every consumer.

We foresee that the enduring value of SMS, bolstered by strong telco provider partnerships, will continue for many years to play an indispensable role in building and maintaining customer relationships.

Monnan Miah

Monnan Miah

Benson Chan

Benson Chan

Chok Seng

Chok Seng