If you are planning to move your legacy, on-premise contact centre to the cloud, there’s no better time to do it.

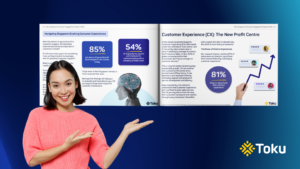

If trust was hard enough to earn, in 2023 it’s even harder to keep. A surge in scams has left consumers wary, fundamentally altering customer experience in Singapore and how consumers interact with brands.

Add to this the evolving technology of generative AI, and businesses find themselves navigating a maze of rising customer expectations and complicated communication channels. These converging challenges point to a volatile customer experience (CX) landscape, where the risk of losing the human touch in customer interactions is alarmingly real.

This is why we commissioned an independent consumer engagement research report surveying the Singapore market in 2023 – to offer crucial insights and strategies for businesses looking to navigate this intricate landscape.

We believe this year’s report will be especially valuable for CX leaders, contact centre managers, and business leaders aiming to maintain trust while elevating customer experience in Singapore.

Download the Toku Singapore Consumer Engagement Report 2023

Learn what makes Singapore consumers trust a brand

Key takeaways on customer experience in Singapore

1. The time-tested channel that still rules for trust and reliability

In an age swamped by new OTT communication platforms, there’s one enduring channel that continues to be the go-to for crucial use-cases like scheduling confirmations and transaction updates.

Businesses shouldn’t be too hasty to overlook this bedrock of reliability, as it enjoys unparalleled universality and has built a legacy of trust over decades.

2. How long customers are willing to wait on the phone for financial peace of mind

When it comes to resolving financial matters, patience isn’t just a virtue—it’s practically a must-have.

Nobody wants to play fast and loose with their finances.

Our data reveals just how long on average, consumers are willing to wait on the phone to settle finance-related queries.

This waiting time offers valuable insights for any business – not just the ones in sectors like banking, fintech, and insurance – but any organisation that has financial transactions with consumers.

3. Elevating customer experience through in-app conversations

Gaining a customer’s trust isn’t simply a one-way street; it’s a two-way dialogue that thrives in a secure environment.

And when communication takes place within the walls of your app, authenticity isn’t just implied—it’s guaranteed.

Our findings reveal a mounting preference for in-app interactions, not just as a convenience but as a fortress of trust.

4. The customer’s verdict on AI-enhanced support

As generative AI sweeps into the customer service sector, it’s not the technology that’s on trial—it’s customer acceptance.

Interestingly, while the tools show promise, public sentiment is still warming up to the idea of AI-powered customer support.

We’ll dive deeper into this in the full report.

5. Who’s more willing to endure negative service experiences: millennials or baby boomers?

When it comes to customer experiences in Singapore, each generation shows a different level of patience when dealing with CX hiccups.

While Baby Boomers have their own views shaped by decades of traditional interactions, Millennials bring to the table an entirely different set of expectations.

So, who proves to be the more forgiving lot when negative service experiences occur?

The answer could shape how you beta test new features, improve processes, and ultimately, win customer loyalty.

Ana Castrillon

Ana Castrillon

Nora Huin

Nora Huin

Beatriz Ruiperez

Beatriz Ruiperez