A new brand to reflect the evolution in our robust suite of cloud communications solutions, position in the market and USPs.

Scams in Singapore show no signs of abating.

Even though victims lost slightly less money in the first half of 2023 compared to the previous year, the number of scam cases has surged by a worrying 64.5%. What’s more, according to a joint study by non-profit organisation Global Anti-Scam Alliance (Gasa) and data service provider ScamAdviser, scam victims in Singapore lost the most money on average globally, at US$4,031 per victim.

And the top five channels used by scammers to engage with would-be victims?

- Messaging platforms like WhatsApp and Telegram,

- Social media,

- Phone calls,

- Online shopping sites, and

- SMSes

Scams don’t just destroy livelihoods – they are reshaping consumer expectations when interacting with businesses. As trust diminishes, businesses face the challenge of delivering genuine experiences amidst a landscape pockmarked with deception.

Recognising this, the Toku team decided to roll up our sleeves and conduct our own research on the issue. We did this with our Singapore Consumer Engagement Report 2022.

We’re back again this year with our 2023 report, unveiling fresh insights and a closer look at how Singapore consumers are navigating this scam-saturated environment.

Curious? Check it out here.

Here are a few takeaways on scam call and SMS consumer behaviour we found particularly intriguing.

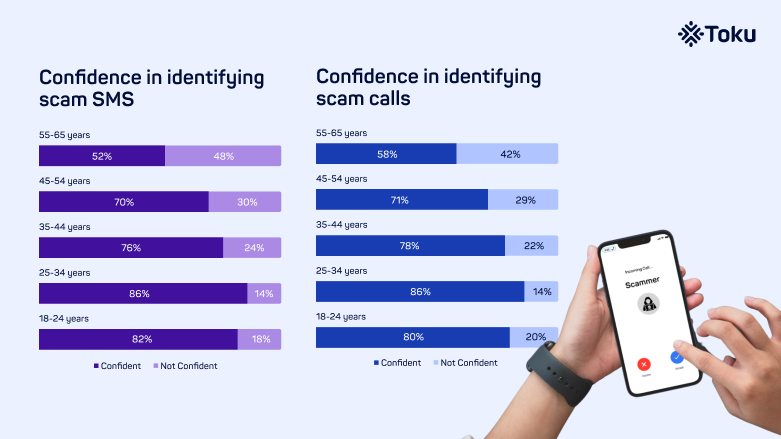

Confidence in spotting scam calls and SMS declines with age

When it comes to pinpointing scam calls or dodgy SMSes, age really does play a part.

Millennials seem to have a sharper eye, but that confidence dips as we move to the older age brackets.

Why it matters for businesses:

For companies that rely on phone calls or SMS to communicate with customers, this confidence drop is a real headache especially when working with more senior customers.

Why? Because when trust in the communication channel gets shaky, that means fewer sales.

Imagine sending out an awesome discount deal via SMS, only to have the customer completely ignore it just to be safe.

Ouch!

Which industries should take note?

Some businesses engage with senior customers more than others. This is especially true for those operating in verticals like healthcare and insurance.

If this sounds like your company, fret not!

Read on to learn about some measures you should take if your company has operations in Singapore and you need to use phone calls and SMS to communicate with your clients.

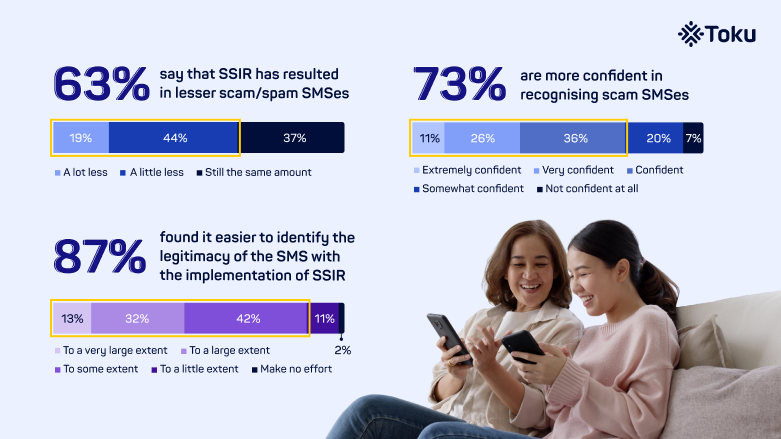

SSIR: A game-changer in battling scam SMSes

Let’s go back in time: It’s 2022, and scam SMSes are the talk of the town in Singapore. Big scams are happening, with one even taking a whopping S$13.7 million from a local bank’s customers. As a result, public trust in SMS messages was plunging rapidly.

Enter the hero, the SMS Sender ID Registry (SSIR), which was introduced in March 2022, and came into full enforcement in January 2023.

The regulation requires businesses to register their SMS Sender IDs if they want to send out SMSes.

If you’re not on the list, your message gets slapped with a “Likely-SCAM” tag.

This move has made both businesses and the public sit up and pay attention.

Following the implementation, 63% of Singapore consumers say they see fewer scam messages, and a whopping 87% say they find it easier to identify legitimate SMS from the suspicious ones.

And in comparison to just 53% in 2022, a notable 73% of respondents now express confidence in their ability to identify scam SMS messages.

Why this matters for businesses operating in Singapore

With all this talk of scams, Singapore consumers are now wary of clicking on SMS links. So, businesses have to up their game.

Getting that SSIR stamp of approval is key, but there’s more to it.

It’s also about staying on top of the rules and building real trust with customers. And for that, partnering with a telco that can support you in navigating the constantly evolving telco regulatory landscape, can be a gamechanger.

Are older folks more likely to fall for scams?

As mentioned earlier, confidence in identifying a scam SMS or call tends to fall as one’s age increases.

However, our data demonstrates that confidence in spotting scams does not necessarily translate to a reduced risk of falling prey to scams.

Despite millennials priding themselves on digital know-how, a surprising chunk of them (36%) willingly clicks on dubious SMS links – the highest proportion amongst all the age groups. In contrast, only 8% of those aged 18-24, and 13% of those aged 45-54, are likely to click on these suspicious SMS links.

Clicking on such links is extremely risky because they can expose users to malware, phishing schemes, and potential financial losses.

Numbers from the Singapore Police Force back our findings: consumers aged 20-39 make up a whopping 53.5% of scam victims – the highest among all age brackets!

Why are so many millennials willing to tap on these suspicious SMS links?

Some reasons come to mind:

- Overconfidence: Growing up swiping and clicking, this group might mistakenly think they’ve got scams all figured out.

- Digital Desensitisation: Being online 24/7 can make it easy for them to underestimate the potential risks.

- The Dare Factor: Let’s face it, some young adults get a kick from living on the edge.

What actions should businesses take to protect consumers from scam SMS and calls in Singapore?

Firstly, companies should register with the SSIR to protect consumers from suspicious SMSes.

Secondly, a company with a proprietary app can offer a safer space for customer engagement through in-app communications. When you leverage in-app calls and in-app chat, these channels are impossible for scammers to spoof, allowing you to create a safer, more trustworthy space for customers to engage with you.

Thirdly, partner with a telco that has the necessary know-how and experience in navigating complex local telco regulations. Singapore’s regulators are taking steps to ensure ‘responsible telcos’ share the responsibility with financial institutions such as banks for phishing scam losses under a proposed Shared Responsibility Framework (SRF).

This means that it’s more important than ever to work with a telco that is experienced in implementing robust security measures, staying compliant with evolving regulations, and proactively mitigating risks associated with digital communications.

Monnan Miah

Monnan Miah

Ana Castrillon

Ana Castrillon

Nora Huin

Nora Huin